We all remember those “Intro to Business” classes from high school, where we learned that the ultimate goal of any business is to be profitable—that is, to make money after covering all expenditures. While businesses also pursue other goals, such as marketing, networking, and client retention, these strategies aim to achieve profitability.

The most effective way to monitor and manage this primary goal of profitability is through Financial Performance Management (FPM). FPM encompasses a range of practices that allow businesses to track their financial health and make informed decisions about their future. Just like any other business tool, FPM offers a variety of approaches and methods that can be tailored to fit a company’s unique needs.

In this blog, we’ll explore the best practices for implementing FPM in your business and discuss why FPM is the foundation of a successful business, much like a sturdy base is crucial for a stable building.

Financial Performance Management – The Foundation

Financial Performance Management – The Foundation

If you ask a construction foreman about building a high-rise or a residential house, they will tell you that it all starts with a solid foundation. Without it, even the most impressive structure will eventually collapse. This principle holds in the business world, particularly within the financial departments of a company. The finance departments—covering areas like payroll, accounts receivable, and accounts payable—are the lifeblood of any business. Money flows in (revenue) and out (expenditures), and the records of these transactions must be accurate and reliable.

Accurate financial data is vital for making informed business decisions. In industries with razor-thin profit margins, such as retail or grocery stores, even a fraction of a percentage point can mean the difference between a profitable quarter and a loss. Good financial sector performance management practices help ensure that every decision is based on up-to-date and precise data. What makes for effective FPM practices? Let’s examine a few essential methods to help businesses maintain their financial stability and growth.

Key Practices in Financial Performance Management

Key Practices in Financial Performance Management

1. Data Accuracy

Accurate data is the cornerstone of effective Financial Performance Management. Many businesses use a dual approach to data management, combining automated software for continuous data mining with manual bookkeeping to verify and validate transactions. This dual approach ensures that the information is always accurate and up-to-date, providing a reliable basis for financial statements like balance sheets, income statements, and cash flow statements.

Accurate records are non-negotiable. A business cannot make sound decisions without precise data, and errors can lead to misguided strategies that could harm the company’s financial health.

2. Scalability

Data accuracy is closely linked to scalability in financial sector performance Management. Scalability refers to a business’s ability to grow and expand—or contract, if necessary—based on current financial conditions. For example, a small startup should not aim to expand too quickly without a stable customer base and sufficient profits to support growth.

Instead, businesses should gradually scale their operations in response to increasing demand, as their financial data indicates. This could mean ramping up production to meet customer demand or scaling down operations during a market downturn. The key is to remain adaptable and make decisions based on accurate data and current market conditions, ensuring the business remains viable even during economic downturns.

3. Data Analysis

Analyzing financial data is another critical component of Financial Performance Management. This process involves evaluating financial data to make informed decisions about the company’s future. For instance, data analysis can help determine whether a company should downsize, invest more in marketing, or adjust its pricing strategy to compensate for shortfalls in other areas.

As mentioned earlier, combining manual input with automated software can provide a comprehensive approach to data analysis. This combination thoroughly examines financial records, helping businesses navigate critical decision points and choose the best path forward.

4. Simplification

Simplicity is key when it comes to Financial Performance Management. “Keep It Simple, Stupid” (K.I.S.S.) is particularly relevant here. FPM processes should be straightforward and accessible to everyone in the organization, not just a few in the finance department. This ensures all employees can input data and understand financial reports, reducing the need for specialized training or extensive labor.

An intuitive, user-friendly FPM system saves time and resources, allowing businesses to streamline their financial processes. This means no more piles of paperwork or quarterly time crunches for financial statements. Instead, businesses can maintain real-time financial data that is easily accessible and understandable.

The Bottom Line

The key takeaway from financial sector performance management practices is that they provide a roadmap for maintaining and improving a business’s financial health. Not utilizing FPM is like walking down a dark path without a flashlight; you may be able to move forward, but you’ll likely stumble. As street lamps illuminate our roads, FPM clarifies making informed financial decisions.

Incorporating these best practices into your business operations ensures a solid foundation for growth and profitability. Financial Performance Management is not just a tool—it’s a necessity for navigating the complexities of today’s business landscape. Start implementing these strategies today and take control of your company’s financial future.

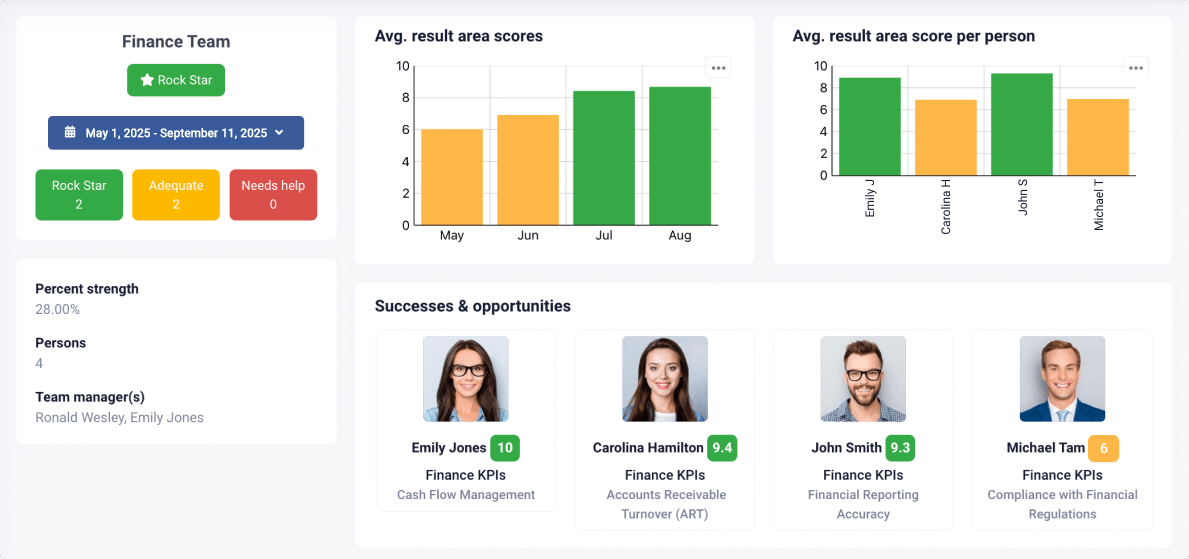

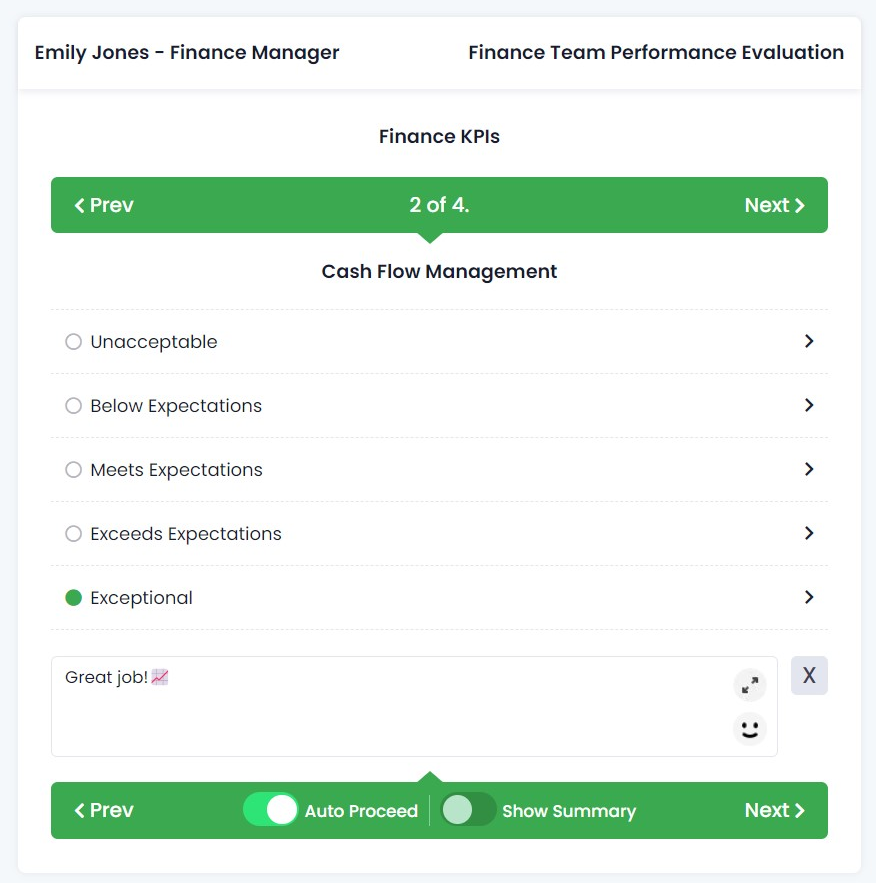

AssessTEAM is a cloud-based performance management software that simplifies employee evaluation, engagement, mentoring, and productivity reporting in one comprehensive suite. It offers over 3,000 customizable key performance indicators (KPIs) or allows users to create their own, making it adaptable for any workforce, from full-time to contractual employees. The platform is easy to use, secure, and supports real-time feedback, continuous evaluations, and multiple evaluation methodologies, such as 360-degree reviews and peer assessments. AssessTEAM integrates seamlessly with popular business tools like Google Suite and Office 365, and its mobile-friendly design enables evaluations on smart devices. The software also tracks real-time profitability, helping businesses improve margins by up to 45% in the first year. With a user-friendly interface and flexible pricing, AssessTEAM is ideal for organizations seeking an efficient and customizable performance management solution.