A. Industry background

A. Industry background

The accounting industry is crucial for keeping the financial world running smoothly. It’s all about tracking and reporting financial transactions so businesses and governments can stay transparent and follow the rules. There are different areas of accounting, like financial, managerial, tax accounting, and auditing, but they all work together to help make good decisions. Over the years, technology has really changed things—accounting software, AI, and even blockchain are making everything faster and more accurate. Also, international standards like IFRS and GAAP help keep things consistent across the globe. Accountants, auditors, and financial experts are key players in making sure everything’s done right, ethically, and legally. Because businesses are getting more complex and regulations are tighter, the demand for accounting services is only growing. That’s why this industry is so important to our economy.

B. Key challenges

The industry faces several key challenges when it comes to performance evaluations for accounting, particularly due to the unique nature of the profession and the evolving business landscape. One significant challenge is the difficulty in assessing intangible contributions such as professional judgment, ethics, and communication skills. These qualities are crucial in accounting but are inherently difficult to quantify. For example, while technical proficiency – like accuracy in financial reporting or meeting regulatory deadlines – can be easily measured, elements like integrity, attention to detail, and decision-making require subjective evaluation. According to a 2022 survey by the American Institute of CPAs (AICPA), over 60% of accounting firms stated that assessing soft skills in employees is one of the most challenging aspects of performance management. These intangible qualities are increasingly important as accountants are expected to move beyond mere number crunching to provide strategic advice and insights to businesses.

Another challenge is the reliance on traditional performance evaluation for accounting methods that may not align with the modern, technology-driven accounting environment. With the rise of automation, artificial intelligence (AI), and machine learning, accountants are increasingly taking on advisory roles rather than performing routine tasks. In fact, a 2023 report by Deloitte highlighted that 63% of accounting professionals believe AI is transforming their job, making their roles more strategic. As a result, performance reviews based solely on output, such as the number of transactions processed or financial statements prepared, may fail to account for an accountant’s ability to navigate complex business issues, offer insights, or adapt to rapidly changing technologies. Without considering these evolving responsibilities, traditional appraisal systems can fail to capture an accountant’s true value to an organization.

Biases in the appraisal process also pose a significant challenge. Studies consistently show that performance reviews in many industries, including accounting, are susceptible to unconscious bias. For instance, a 2021 study by McKinsey found that women in the accounting industry are often rated lower in performance appraisals than their male counterparts, despite comparable outcomes. Furthermore, a bias toward “visible” performance, such as the ability to meet tight deadlines, can overshadow other essential aspects like teamwork, client relationship management, and long-term strategic planning. According to a 2020 study by Gallup, 43% of employees feel that their performance reviews are unfair or do not accurately reflect their contributions. This bias can lead to inaccurate appraisals and affect employee morale and retention, particularly in a field like accounting, where attention to detail and a well-rounded skill set are essential.

The rapid pace of regulatory changes also complicates the establishment of consistent benchmarks for performance. The accounting profession is constantly evolving, with financial reporting standards and tax regulations undergoing frequent updates. For example, the implementation of new tax reforms or the adoption of the International Financial Reporting Standards (IFRS) in different jurisdictions can drastically shift the expectations and responsibilities of accounting professionals. According to the Financial Accounting Standards Board (FASB), over 40 changes to U.S. Generally Accepted Accounting Principles (GAAP) were made in 2023 alone. This ongoing shift means that performance appraisals based on outdated benchmarks or processes may not accurately reflect an employee’s ability to adapt to new standards or address emerging challenges in the field.

Finally, with the increasing trend toward remote and hybrid work, ensuring fair, accurate, and consistent performance reviews can be difficult when managers have limited direct interaction with their teams. A 2024 survey by PwC found that 45% of accountants now work in a hybrid or fully remote capacity, making it harder for managers to assess day-to-day contributions and interpersonal dynamics, which are essential for a comprehensive performance review. Remote work also challenges traditional performance metrics, like “face-time,” which might have once been an indicator of work ethic or commitment. As a result, managers must adjust their evaluation methods to focus on outcomes, communication, and productivity rather than simply the time spent at the office.

These challenges highlight the need for more dynamic and comprehensive performance appraisal systems in the accounting industry. To be successful, these systems must evolve alongside technological advancements and changing industry standards, focusing on a broader range of competencies—both technical and soft skills. Organizations may also need to implement training programs to help managers identify and mitigate biases in the appraisal process, ensuring fairness and accuracy. Ultimately, a well-rounded, forward-thinking performance appraisal system will be essential for fostering employee growth, improving retention, and maintaining the integrity of the accounting profession in an increasingly complex and competitive environment.

C. Solutions offered

C. Solutions offered

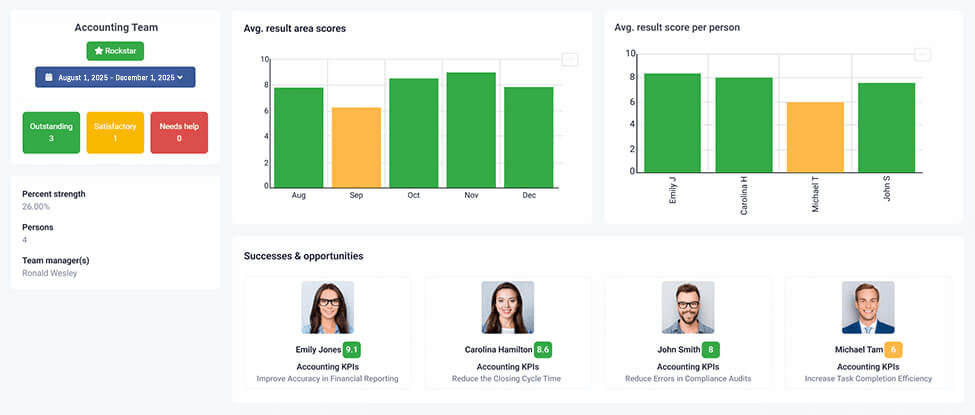

Overcoming these challenges requires structured performance management in accounting tailored to the unique needs of accounting teams. AssessTEAM is ideally suited to assist accounting firms in shifting to monthly, weekly, or even daily performance tracking, thanks to the robust features of its real-time performance appraisal system.

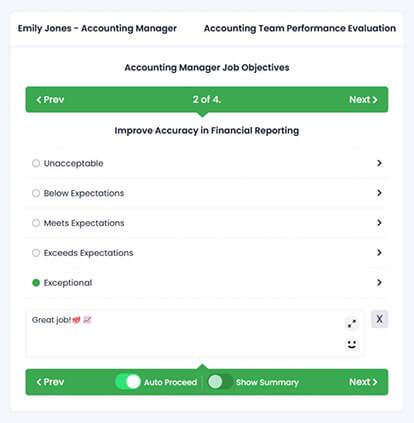

1. Define Clear and Relevant Metrics: AssessTEAM helps accounting organizations define clear, role-specific metrics for accounting staff, such as accuracy in reporting, task completion times, and adherence to compliance standards. The platform allows for customized performance benchmarks to align with specific job responsibilities, ensuring that evaluations are both relevant and meaningful.

2. Provide Timely, Real-Time Feedback: With AssessTEAM’s real-time performance appraisal system, managers can provide immediate feedback to accounting staff, addressing both achievements and mistakes right when they occur. This proactive approach fosters accountability, promotes continuous improvement, and prevents issues from escalating.

3. Incorporate Peer and Self-Assessments: AssessTEAM supports peer and self-assessments, enabling accounting teams to evaluate each other’s contributions and collaborate more effectively. Peer evaluations provide insight into teamwork and interpersonal skills, while self-assessments encourage personal reflection and engagement in the evaluation process.

4. Emphasize Professional Development: AssessTEAM not only tracks areas for improvement, it also highlights professional growth opportunities. The platform allows managers to set development goals, such as pursuing certifications or mastering new tools, helping accounting staff stay motivated and develop their skills to meet evolving industry demands.

5. Leverage Advanced Performance Tools: With AssessTEAM’s advanced performance tools, accounting evaluations are streamlined through automation and customizable templates for data collection. This ensures that performance reviews are consistent, efficient, and based on accurate, data-driven insights, saving time while improving the quality of evaluations.