Risk Management Employee Objectives

The risk management employee objectives or KPIs are designed to track and measure the risk management employee’s operational efficiencies over time, including improving the number of risks identified, improving the Predicted Risk Severity compared to the Actual Risk Severity ratio, and reducing the number of risks occurring multiple times.

- Improve the number of risks identified – This KPI tracks and measures the extent to which the risk management employee is able to improve the number of risks identified over time. The higher this metric, the greater the risk management employee’s ability to increase the number of risks identified over time.

- Improve (reduce) the number of risks that occurred and became issues over time – This KPI measures the extent to which the risk management employee is able to improve or reduce the number of risks that occurred and became issues over time. The higher this metric, the greater the risk management employee’s ability to reduce the number of risks that occurred and became issues.

View all

- Improve (reduce) the number of risks that occurred more than once – This KPI tracks and measures the risk management employee’s ability to improve or reduce the number of risks that occurred more than once over time. The higher this metric, the greater the risk management employee’s operational efficiencies.

- Improve the Predicted Risk Severity compared to the Actual Risk Severity – This KPI tracks and measures the extent to which the risk management employee is able to improve the Predicted Risk Severity compared to the Actual Risk Severity ratio over time. The higher this metric, the greater the risk management employee’s operational efficiencies.

- Improve (reduce) the number of risks that were not identified – This KPI tracks and measures the extent to which the risk management employee is able to improve or reduce the number of risks that were not identified. The higher this metric, the greater the risk management employee’s operational efficiencies over time.

View less

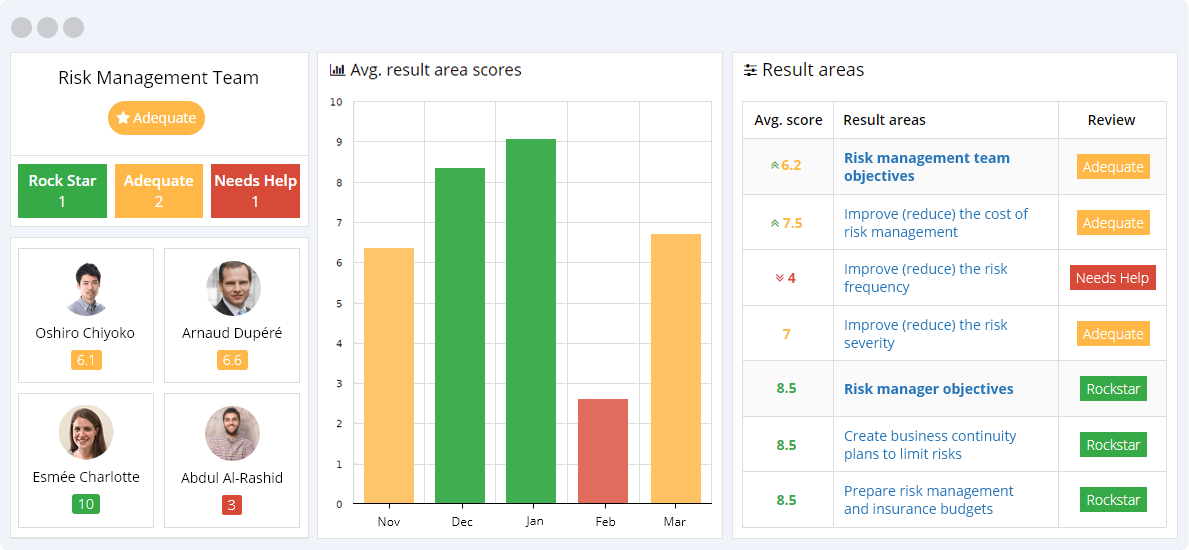

Risk Management Team Objectives

The risk management team objectives or KPIs are designed to track and measure the risk management team’s operational efficiencies over time, including reducing the overall risk management costs, improving the number of risks closed, reducing the frequency of risks occurring, and reducing the severity of the risks.

- Improve (reduce) the cost of risk management – This KPI tracks and measures the extent to which the risk management team is able to improve or reduce the cost of risk management over time. The higher this metric, the greater the risk management team’s ability to reduce risk management costs over time.

- Improve the number of risks closed – This KPI tracks and measures the extent to which the risk management team is able to improve the number of risks closed over time. The higher this metric, the greater the risk management team’s ability to increase the number of risks closed over time.

View all

- Improve (reduce) the risk frequency – This KPI tracks and measures the extent to which the risk management team is able to improve or reduce the risk frequency over time. The higher this metric, the greater the risk management team’s ability to reduce the risk frequency over time.

- Improve (reduce) the risk severity – This KPI tracks and measures the risk management team’s ability to improve or reduce the risk severity over time. The higher this metric, the greater the extent to which the risk management team is able to reduce the risk severity over time.

- Build risk awareness amongst staff by providing support and training within the company – This KPI tracks and measures the risk management team’s ability to build risk awareness amongst staff by providing support and training within the company. The higher this metric, the greater the risk management team’s operational efficiencies over time.

View less

Risk Manager Objectives

The risk manager KPIs are designed to track and measure the riks manager’s operational efficiencies over time, including elements such as improving the speed and effectiveness of solutions to risks, creating business continuity plans to limit risks, preparing risk management and insurance budgets, and conducting risk policy and compliance audits.

- Improve the speed and effectiveness of the risk-based solutions – This KPI tracks and measures the extent to which the risk manager is able to improve the speed and effectiveness of the risk-based solutions over time. The higher this metric, the greater the risk manager’s ability to improve the speed and effectiveness of the risk-based solutions over time.

- Explain the external risk posed by corporate governance to stakeholders – This KPI tracks and measures the extent to which the risk manager is able to explain the external risk posed by corporate governance to stakeholders. The higher this metric, the greater the risk manager’s ability to explain the external risk posed by corporate governance to stakeholders.

View all

- Create business continuity plans to limit risks – This KPI tracks and measures the extent to which the risk manager is able to create business continuity plans to limit risks over time. The higher this metric, the greater the risk manager’s ability to create business continuity plans to limit risks.

- Implement health and safety measures and purchase risk insurance – This KPI tracks and measures the extent to which the risk manager is able to implement health and safety measures and purchase risk insurance. The higher this metric, the greater the risk manager’s ability to implement health and safety measures and procure the necessary risk insurance.

- Conduct policy and compliance audits, including liaising with internal and external auditors – This KPI tracks and measures the extent to which the risk manager is able to conduct policy and compliance audits, including liaising with internal and external auditors over time. The higher this metric, the greater the risk manager’s operational efficiencies.

- Maintain records of insurance policies and claims – This KPI tracks and measures the extent to which the risk manager is able to maintain records of insurance policies and claims over time. The higher this metric, the greater the risk manager’s ability to maintain records of insurance policies and claims accurately.

- Review any new major contracts or internal business proposals – This KPI tracks and measures the extent to which the risk manager is able to review any new major contracts or internal business proposals. The higher this metric, the greater the risk manager’s ability to review any new major contracts or internal business proposals.

- Establish the level of risk the company is willing to take – This KPI tracks and measures the extent to which the risk manager is able to establish the level of risk the company is willing to take. The higher this metric, the greater the risk manager’s ability to establish the level of risk the company is prepared to take.

- Prepare risk management and insurance budgets – This KPI tracks and measures the extent to which the risk manager is able to prepare risk management and insurance budgets over time. The higher this metric, the greater the risk manager’s ability to prepare risk management and insurance budgets over time.

- Analyze current risks and identify potential risks that can affect the company – This KPI tracks and measures the risk manager’s ability to analyze current risks and identify potential risks that can affect the company over time. The higher this metric, the greater the extent to which the risk manager can analyze current risks and identify potential risks affecting the company over time.

View less

These risk management KPIs are an integral part of ensuring that the risk management employee and team and risk manager meet their critical organizational efficiencies. In addition, the successful implementation of the health and safety strategy plays a vital role in ensuring that the workplace meets minimum health and safety standards, ensuring a low-risk or risk-free environment. As a result, measuring these objectives is key to organizational success. They focus on tracking metrics grouped in three result areas: employee, team, and manager.

It is essential to track and measure these KPIs over time because they offer insight into the organization’s risk management team’s efficiencies and where improvements are needed. Metrics like improving the number of identified risks, reducing the frequency and severity of risks occurring, creating business continuity plans to limit risks, and analyzing current risks, and identifying potential risks that can affect the company are integral to ensuring a healthy and safe workplace for all employees throughout the organization.

Implementing risk management objectives or KPIs for the risk management team, employee, and manager drives the need to ensure consistency over time. High-performing metrics are valued, translating into an effective risk management strategy and the application by the risk management team. On the other hand, low-performing metrics must be revisited as they indicate poor performance and detract from operational and organizational success metrics.